Five of the UK’s largest banks published remuneration reports – E-reward analysis

Last week, a number of the UK’s largest FTSE 100 companies were the first to publish annual reports with financial year-ends dated December 2016. This information has now been added to the E-reward Summit Executive Remuneration Database making it possible for us to gain an insight into how our leading companies are responding to the many concerns voiced over executive remuneration in recent months.

UK remuneration policy is in a state of flux and some of these organisations have set out their new remuneration reports that will be in place for the next three years providing concrete details of how executive pay is evolving. It is obvious from the evidence from these companies that they are taking on board the views of various interest groups although their reports illustrate that there is still uncertainty in some areas over the future direction of policy.

What emerges from the examples is a number of clear changes in the direction in remuneration policy for certain elements of pay and a wait-and-see approach in those areas where a clear consensus has yet to surface. As a result, while not presenting us with the final destination of UK remuneration policy, the examples at least provides more of an idea of the direction of travel we are likely to witness in the near future.

UK’s largest banks

Five of the UK’s largest banks published remuneration reports in the last few days including:

- Barclays

- HSBC

- Lloyds Banking Group

- Royal Bank of Scotland

- Standard Chartered.

These banks employ a total of over 580,000 people worldwide and have a combined market capitalisation of over £270 billion. In addition, finance companies are among the most heavily regulated of any while the sector is under extreme scrutiny. As a result, their latest reports provide a good opportunity to take a closer look at how policy is evolving in the UK’s leading companies.

Key trends

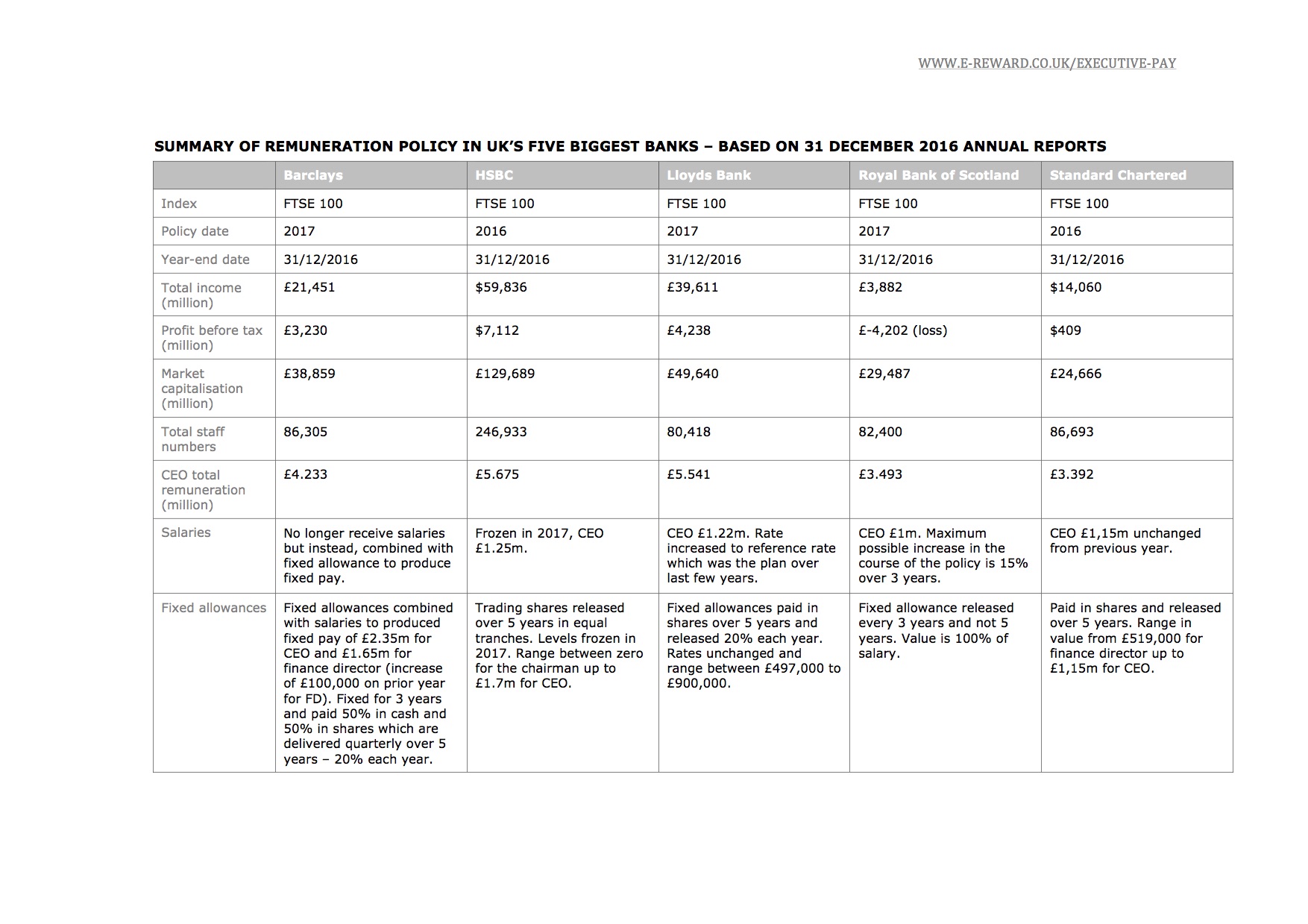

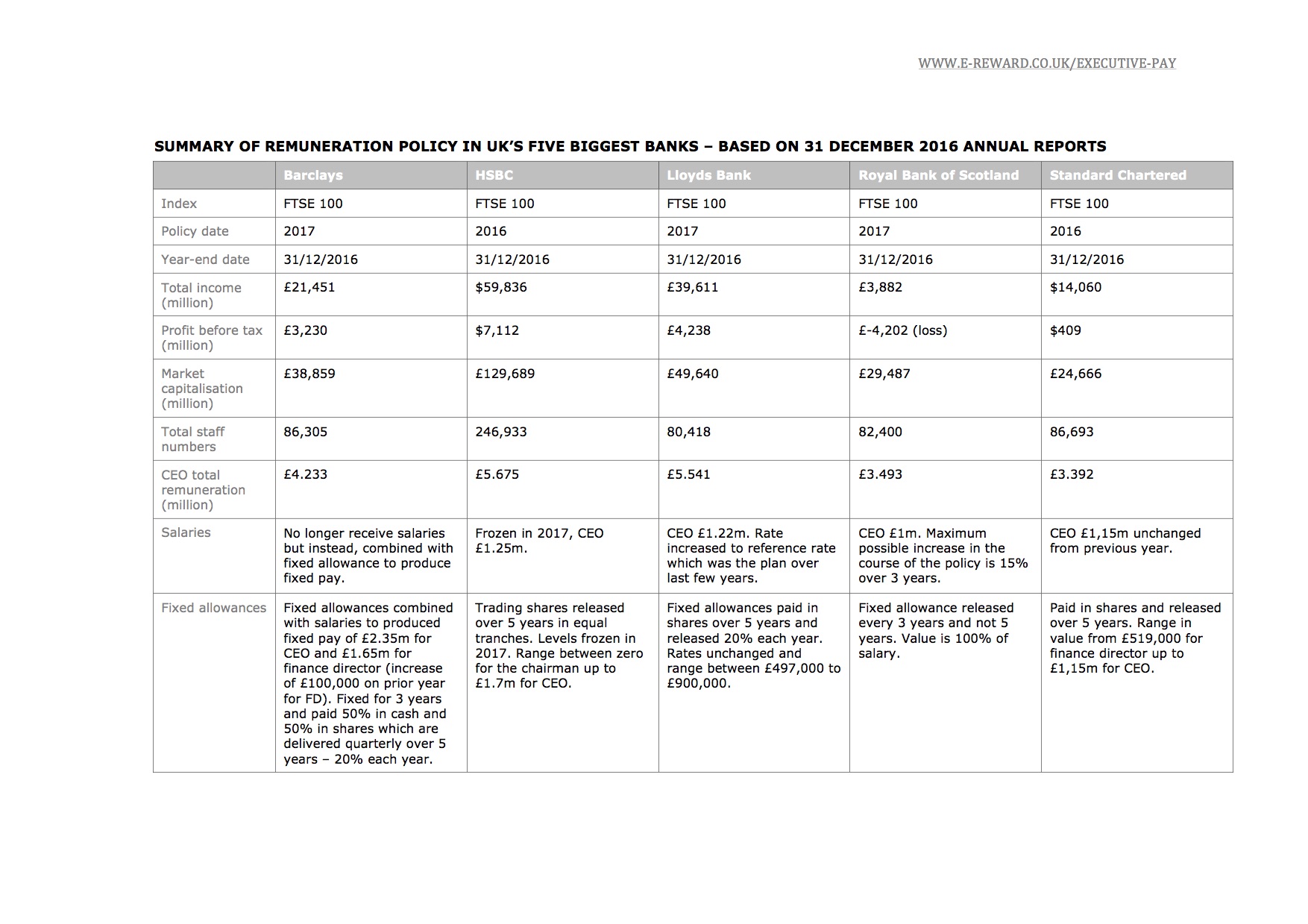

A subset of the policy data that the Summit database holds is given in the table but a summary of the trends that emerge includes:

- Overall, the trend to simplify remuneration policy continues with new policies.

- In particular, the choice of incentive targets is developing with less emphasis on the traditional financial measures that have been used in the past in favour of others thought to be more within the control of individual directors that also provide a clearer line of sight.

- In addition, in some cases the quantum of remuneration is reducing with adjustments to incentive plan maxima and more widely, beyond the board level, incentive pools in this sector have reduced significantly.

- All of these companies’ chief executives have salaries of £1 million or more and base pay rises have been largely subdued.

- Policies on fixed allowances are, to some extent in flux. At Royal Bank of Scotland, the release period has been reduced from five years to three while at Barclays, the fixed allowance has been combined with salary to produce fixed pay.

- Standard benefits policy largely unchanged.

- Pension allowances reducing in size but mainly for new hires. At Barclays new hires will receive 10% of fixed pay, at Lloyds and Royal Bank of Scotland 25% of salary, while at Standard Chartered the rate will be reviewed when a new appointee is made. At HSBC, existing directors will have their allowances reduced from 50% to 30%.

- For annual bonus plans, more focus on deferral and while this is no doubt because of the tighter regulations in the finance sector, it is a trend we have witnessed more broadly.

- Bonus targets seem to be moving more towards strategic measures that are considered more in the control of individual directors.

- Similarly, LTIP’s are subject to longer deferral periods and additional holding periods partly due to finance sector regulation but also likely to be the trend more generally.

- In addition, RBS has a pre-grant performance condition for its new LTIP.

- As with bonuses, LTIP targets less focused on traditional measures such as TSR with a broader spread including other strategic targets that are less affected by general market movements and more germane to individual company performance.

- In addition, targets as well as underpins are incorporating more measures reflecting the company’s impact on the wider community. For example, RBS has an underpin for its LTIP which includes stakeholder perceptions while some of the companies examined had targets relating to customers, service quality and client relationships.

- Holding periods becoming more prevalent with Barclays going further by requiring directors to hold shares for two years post-employment.

- Total remuneration levels ranging from £3.4 million at Royal Bank of Scotland and Standard Chartered up to around £5.5 million at HSBC and Lloyds Banking Group.

- Future pay scenarios for CEOs illustrated maximum amounts ranging from £4.1 million at Royal Bank of Scotland to £9.975 million at HSBC.

- Worst-case scenarios for CEO’s still resulted in amounts ranging from £2.4 million at Royal Bank of Scotland up to £3.3 million at HSBC.

- With regard to recruitment, most companies provide a standard policy but some companies are providing more detail on interim recruits, non-executive directors taking on executive roles temporarily and where directors join partway through the year. As mentioned above, pension allowance levels will be lower for new recruits.

- Details on leavers also seem to be improving with more granular detail on different leaver scenarios.

- Shareholding requirements are on the increase with more details on the proportion of incentive awards that must be held before the requirement is met.

- Looking beyond the board, the size of incentive pools more generally has reduced significantly in this sector as illustrated in all the companies examined.

- Despite this, there are still significant numbers of employees in all five banks that receive substantial sums. For example 364 people at Barclays receive over £1 million while 58 at Lloyds were equally fortunate.

- Non-executive chairman rates range between £728,280 at Lloyds Banking Group up to £1,250,000 at Standard Chartered.

- Basic non-executive director rates range between £76,500 at Lloyds to £100,000 at Standard Chartered.

- In total the banks paid £900,000 in remuneration consultancy costs ranging from £48,000 at Barclays to £416,200 at Lloyds Banking Group.

Want to know more?

E-reward collects, aggregates and analyses vast amounts of board-level remuneration data from company reports to inform your decision-making. Our subscription, research and bespoke services are built upon this data, expertise and independence.

Summit, our executive remuneration database, is an unrivalled source of UK executive remuneration information for pay consultants, Remco members and reward/HR specialists. Stretching back to 2002, it includes information ranging from the largest FTSE 100 companies to the smallest Fledgling and AIM firms gathered from company accounts.

For more information, please visit: www.e-reward.co.uk/executive-pay